Vehicle insurance isn’t just a legal obligation; it protects you, your vehicle, and others in the event of an accident. This can save you thousands of pounds in damages and legal fees, but only if you’ve got the right insurance.

Having proper insurance in place can give you peace of mind, whether you drive a car, van, motorhome, or something else. If you want to make sure you’re fully protected, no matter who’s at fault, keep reading our guide and learn what to look for when selecting insurance.

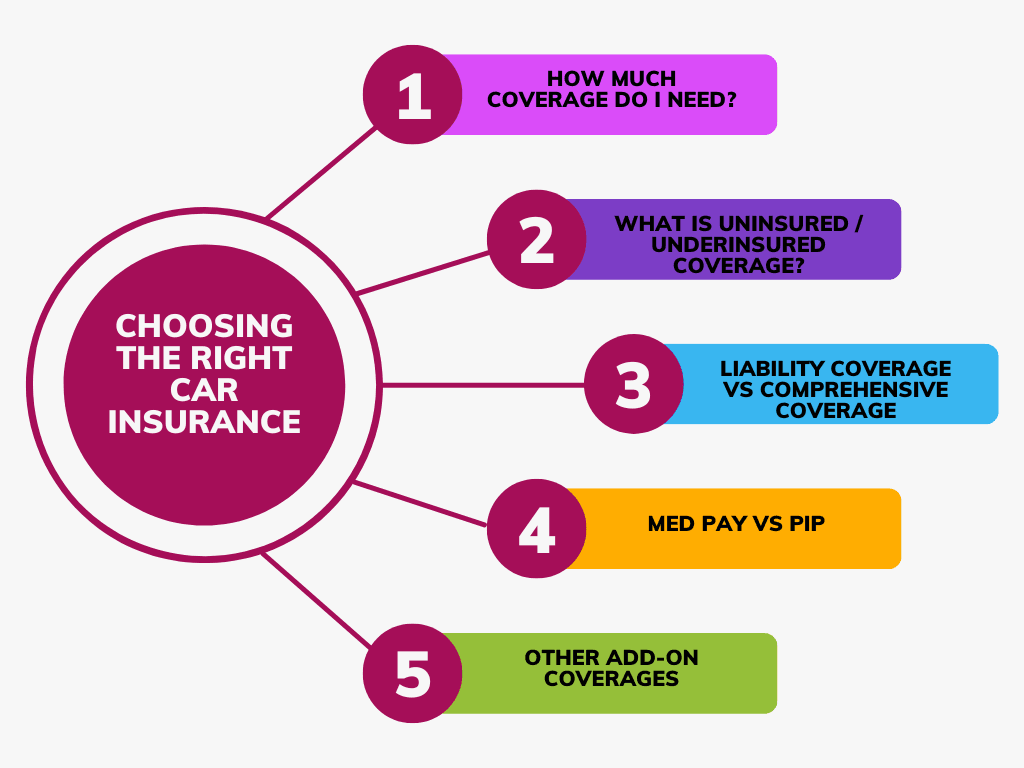

Understand the different types of insurance

Before you pick the cheapest insurance and call it a day, you should probably know the difference between the various insurance options. We’ve explored some common types available to most UK drivers.

Third-Party

As the cheapest option, third-party insurance offers the most basic cover for your vehicle. This is the minimum level of protection you can get, and because of that, it will only affect other drivers.

That means if you cause an accident and there’s damage to both vehicles, your insurance will only pay for the repairs to the other person’s vehicle. Your own will have to be repaired out of your own pocket. It also means that if your car gets stolen or fire-damaged, you’re completely unprotected – unless you have opted for an extra ‘theft and fire’ package.

Comprehensive

A much higher level of protection, comprehensive insurance protects you (the driver), your car, and any third parties involved in an accident. While your payments are usually higher than third-party insurance, the difference can be negligible, especially considering the difference in protection.

With fully comprehensive insurance, you are covered in the event of theft or fire, and you can rest easy knowing that if an accident occurs, your car will be fixed no matter who’s at fault.

Vehicle age and value

Of course, the difference in coverage is usually reflected in the price. When choosing the coverage you need, it’s always worth considering your vehicle’s value first. For example, an older car that’s only worth several hundred pounds might not need comprehensive cover.

On the other hand, opting for third-party cover when you’ve just bought a brand new top-of-the-range motorhome can be a costly mistake. When buying insurance, the vehicle’s age and condition can impact the premiums and coverage options, so you must factor this in when choosing your policy.

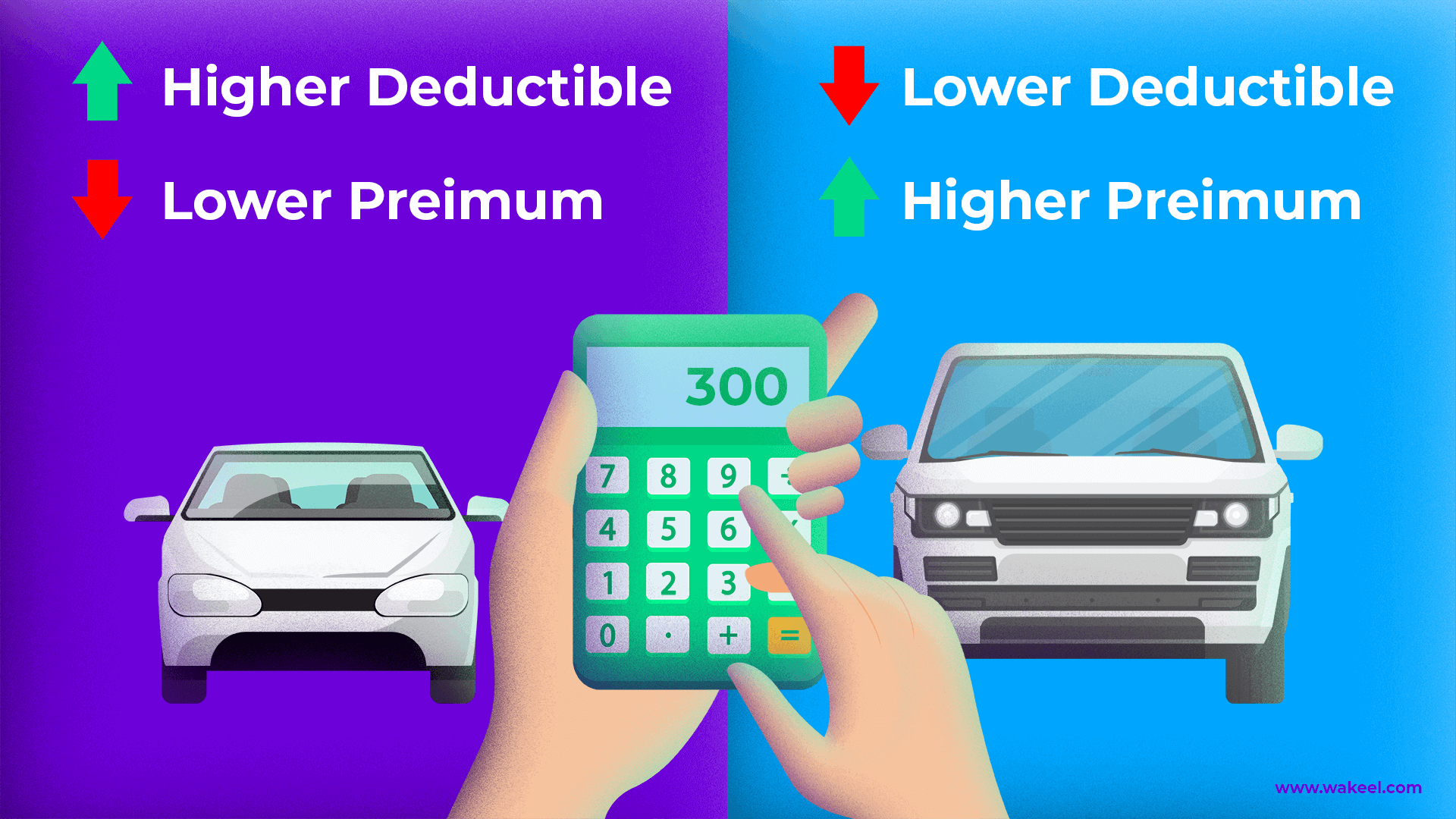

Look at the excess and premium balance

Something to remain aware of when considering insurance is the balance between your excess and premiums. The excess is the amount you pay out-of-pocket in the event of a claim. Meanwhile, your premiums are what you pay every month.

Typically, a higher excess will reduce your monthly premiums, while a lower excess raises them. This balance can drastically change how much you pay over time, at the risk of paying more yourself if an accident occurs.

Motorhome and campervan owners, especially, should be aware of the balance, as campervan insurance can have vastly different payment structures compared to car insurance. If you own a motorhome, it’s vital you carefully consider the specific coverage needs for both your vehicle and its contents.